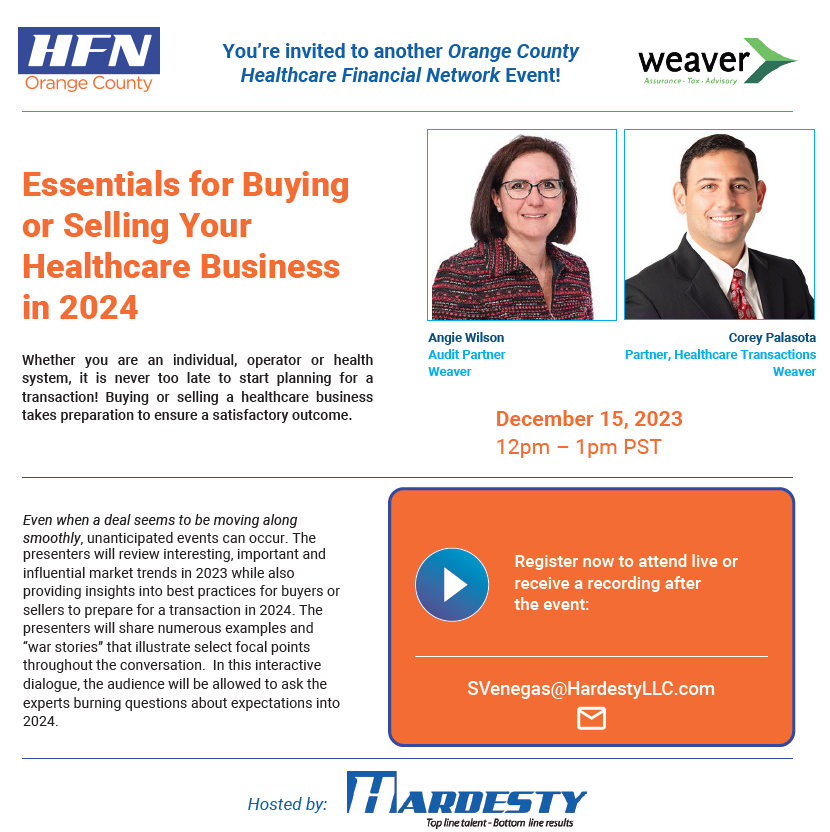

Essentials for Buying or Selling Your Healthcare Business in 2024

schedule

Friday, December 15, 3:00pm - 4:00pm (EST)

south_america expand_more Time shown in-04:00 America, New York

OCHFN proudly welcomes you to join us for another fascinating and informative webinar!

Whether you are an individual, operator or health system, it is never too late to start planning for a transaction. Buying or selling a healthcare business takes preparation to ensure a satisfactory outcome. Even when a deal seems to be moving along smoothly, unanticipated events can occur. The presenters will review interesting, important and influential market trends in 2023 while also providing insights into best practices for buyers or sellers to prepare for a transaction in 2024. The presenters will share numerous examples and “war stories” that illustrate select focal points throughout the conversation. In this interactive dialogue, the audience will be allowed to ask the experts burning questions about expectations into 2024.

Co Hosts:

Angie Wilson

Audit Partner

Weaver

Angie Wilson, CPA, MBA, has more than 25 years of experience providing senior-level financial, accounting and tax services, and advising companies in the health care and biotech industries preparing for audits, IPOs and financing transactions. Angie began her career at a Big Four firm, where she spent 18 years working as an audit senior through partner level for various health care clients, leading their Los Angeles Health Care Audit Practice from 2012-2014.

Angie has also served in leadership roles within public accounting firms and public and private companies, including Chief Financial Officer and Vice President Controller of a biotech public company, and Vice President/Controller at a PE-backed company.

*******

Corey Palasota

Partner, Healthcare Valuation services

Weaver

Corey Palasota, CFA, has more than 15 years of experience in health care valuation and transaction M&A advisory services. Corey plans, supervises and reviews multiple health care engagements for fair market value (FMV) and compliance matters on behalf of health systems, attorneys, physicians, private equity groups and individuals. His appraisal services are used for acquisitions, joint ventures, mergers and minority equity transactions. Corey also provides consulting services to help health care executives make investment or strategic decisions by performing financial analysis, preliminary due diligence and market research. He has served clients of all sizes and geographies across the entire health care spectrum.

Confirmed.

We've sent a confirmation email to your email address. Be sure to check your junk folder in case you haven't received the confirmation.

Confirmed.

We've sent a confirmation email to your email address. Be sure to check your junk folder in case you haven't received the confirmation.

Thank you!

Your changes have been saved. Thanks for keeping us updated.

location_on

https://us02web.zoom.us/j/81197515502?pwd=PkbbLXjJeGtlUAcB5z1PYuX0JCdIzd.1

person

Spencer Venegas, SVenegas@HardestyLLC.com